- Your cart is empty Browse Shop

Comprenensive Saas solution for managing the complete lifegyde of asset retirement obligations.

Asset Retirement

Obligation

Management

Platform

From Planning To Decommissioning

End-to-End ARO

Ensure regulatory compliance, optimize costs and streamline your ARO processes with our intelligent platiorm.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Comprehensive financial and accounting framework for asset retirement obligations

What is Asset Retirement Obligation ?

Accounting Framework

Canadian Requirements

ARO Components

Financial Definition & Legal Framework

Accounting Framework

Asset Retirement Obligations (AROs) represent legally binding financial liabilities associated with the future retirement of tangible long-lived assets. Under ASC 410-20 (US GAAP) and LAS 37/IFRIC 1 (IFRS), companies must recognize ARO liabilities when they have a legal obligation to perform asset retirement activities.

ASC 410-20 (US GAAP)

>Initial measurement at fair value.

>Present value of future cash flows.

>Credit-adjusted risk-free rate.

>Asset retirement cost capitalization

>Present value of future cash flows.

>Credit-adjusted risk-free rate.

>Asset retirement cost capitalization

IFRS (AS 37/IFRIC 1)

>Probable outflow of resources.

>Reliable estimate possible.

>Best estimate of expenditure.

>Time value of money consideration.

>Reliable estimate possible.

>Best estimate of expenditure.

>Time value of money consideration.

A Critical Recognition Criteria: ARO must be recognized when (1) legal obligation exists. (2) ebligation

results from past events and (3) retirement costs can be reasonably estimated.

AWS Glue

A serverless data integration service that makes it easy to discover, prepare, and combine data for analytics, machine learning, and application development. Our implementation delivers seamless ETL processes tailored to your business requirements.

Lake Formation

A service that makes it easy to set up, secure, and manage your data lake, providing a single place to catalog, clean, and secure your data. Our implementation expertise ensures a properly governed data lake that meets your specific needs.

Amazon Athena

An interactive query service that makes it easy to analyze data directly in Amazon S3 using standard SQL. Our implementation ensures you can query massive datasets efficiently without the need to load or manage databases.

Key Accounting Entries & Financial Impact

Initial Recognition

Dr. Asset Retirement Cost

$2,500,000

Cr. ARO Liability

$2,500,000

To record ARO liability at present value of estimated future retirement costs.

Estimate Revision (Increase)

Dr. Asset Retirement Cost

$300,000

Cr. ARO Liability

$300,000

To record upward revision in estimated retirement costs.

Annual Accretion

Dr. Accretion Expense

$125,000

Cr. ARO Liability

$125,000

To record time value increase in ARO liability (typically 5–7% discount rate).

Settlement

Dr. ARO Liability

$3,200,000

Dr. Loss on Settlement

$150,000

Cr. Cash

$3,350,000

To record settlement of ARO and recognize gain/loss on actual costs.

Financial Statement Impact

Key Challenges For Finance & Accounting Teams

How Our Platform Addresses These Issues

Automated calculations, real-time estimate revisions, built-in compliance controls, and comprehensive audit trails – designed specifically for finance and accounting professionals.

Comprehensive enterprise-grade ARO management solution with integrated financial systems

Platform Features

Complete End-to-End Solution: From initial obligation recognition to final settlement

Financial Management & Accounting

Built-in financial systems for complete ARO accounting lifecycle

Add Your Heading Text Here

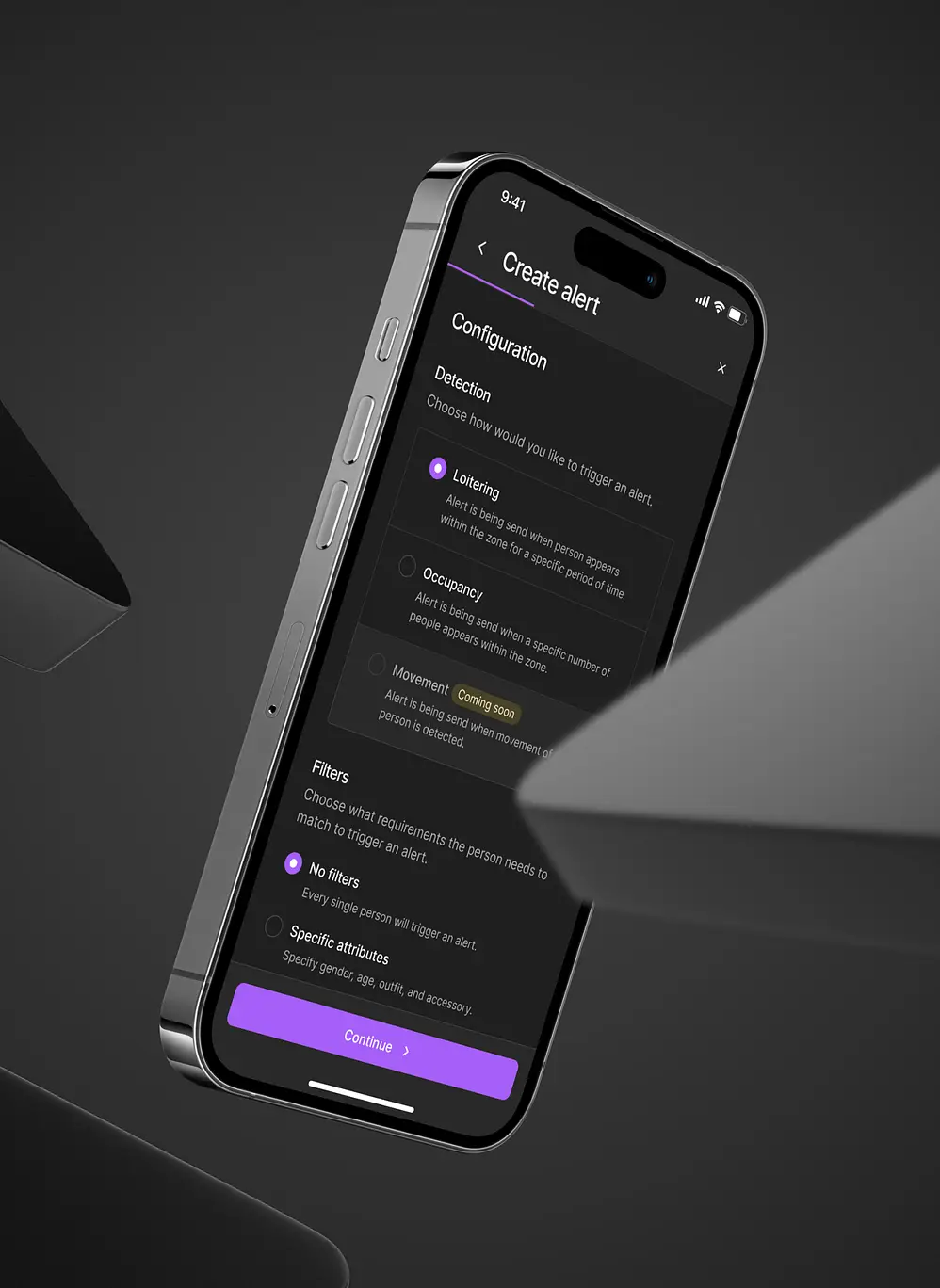

Comprehensive workbench interface for complete ARO lifecycle management with integrated configuration, processing, and calculation modules.

✔️ ARO Configuration management

✔️ Transactional Processing workflows

✔️ Obligation Management dashboard

✔️ Cost Layer Management tools

✔️ Calculate FV & NPV functions

✔️ Cost Layer Cashflows analysis

✔️ Transactional Processing workflows

✔️ Obligation Management dashboard

✔️ Cost Layer Management tools

✔️ Calculate FV & NPV functions

✔️ Cost Layer Cashflows analysis

Journal Entry Management

Automated journal entry generation with full audit trails and approval workflows for all ARO transactions.

✔️ Automated journal entry creation

✔️ Multi-GAAP support (ASC 410-20 & IFRS)

✔️ Accretion expense automation

✔️ Revision adjustment entries

✔️ Settlement and gain/loss recognition

✔️ Multi-GAAP support (ASC 410-20 & IFRS)

✔️ Accretion expense automation

✔️ Revision adjustment entries

✔️ Settlement and gain/loss recognition

Mini Financial Account System

Integrated chart of accounts specifically designed for ARO management with automated reconciliation capabilities.

✔️ ARO-specific chart of accounts

✔️ Asset retirement cost tracking

✔️ Liability balance management

✔️ Automated account reconciliation

✔️ ERP system integration ready

✔️ Asset retirement cost tracking

✔️ Liability balance management

✔️ Automated account reconciliation

✔️ ERP system integration ready

Operational Management & Workflow

Streamlined operations from planning to execution

Scenario Management

Comprehensive scenario planning and modeling for different decommissioning approaches with financial impact analysis.

✔️ Multiple scenario modeling

✔️ What-if and predictive outcomes

✔️ Cost-benefit comparisons

✔️ Weighted scenario outcomes

✔️ Scenario approval workflows

✔️ What-if and predictive outcomes

✔️ Cost-benefit comparisons

✔️ Weighted scenario outcomes

✔️ Scenario approval workflows

Work Order Management

End-to-end work order lifecycle management from planning through execution with cost tracking and resource allocation.

✔️ Work order creation and scheduling

✔️ Resource allocation and tracking

✔️ Contractor management integration

✔️ Escalation routing and response

✔️ Cost capture and variance analysis

✔️ Resource allocation and tracking

✔️ Contractor management integration

✔️ Escalation routing and response

✔️ Cost capture and variance analysis

Event & Task Tracking

Intelligent event monitoring and automated task management with configurable notifications and escalation procedures.

✔️ Automated event detection

✔️ Task assignment and tracking

✔️ Configurable notification rules

✔️ Escalation procedures

✔️ Calendar integration and reminders

✔️ Task assignment and tracking

✔️ Configurable notification rules

✔️ Escalation procedures

✔️ Calendar integration and reminders

Compliance, Security & Documentation

Enterprise-grade security with comprehensive compliance management

Document Management

Centralized document repository with version control, digital signatures, and automated retention policies.

✔️ Centralized document repository

✔️ Version control and history

✔️ Digital signature integration

✔️ Automated retention policies

✔️ Advanced search and tagging

✔️ Version control and history

✔️ Digital signature integration

✔️ Automated retention policies

✔️ Advanced search and tagging

Enterprise Security

Bank-grade security infrastructure with multi-factor authentication, encryption, and comprehensive audit logging.

✔️ Multi-factor authentication (MFA)

✔️ Role-based access controls (RBAC)

✔️ End-to-end data encryption

✔️ SOC 2 Type I compliance

✔️ Comprehensive audit trails

✔️ Role-based access controls (RBAC)

✔️ End-to-end data encryption

✔️ SOC 2 Type I compliance

✔️ Comprehensive audit trails

Regulatory Compliance

Automated compliance tracking and reporting for ASC 410 and IFRS requirements.

✔️ ASC 410 compliance automation

✔️ IFRS standards alignment

✔️ Regional regulatory support

✔️ Automated compliance reporting

✔️ Audit preparation tools

✔️ IFRS standards alignment

✔️ Regional regulatory support

✔️ Automated compliance reporting

✔️ Audit preparation tools

Analytics & Comprehensive Reporting

Advanced analytics and reporting for strategic decision-making

Comprehensive Reporting

Advanced reporting suite with real-time dashboards, customizable analytics, and executive-level summaries.

✔️ Real-time executive dashboards

✔️ Customizable report builder

✔️ Financial statement integration

✔️ Budget vs. actual variance analysis

✔️ Predictive analytics and forecasting

✔️ Automated report distribution

✔️ Customizable report builder

✔️ Financial statement integration

✔️ Budget vs. actual variance analysis

✔️ Predictive analytics and forecasting

✔️ Automated report distribution

System Integration Hub

Seamless integration with ERP systems, accounting software, regulatory databases, and third-party applications.

✔️ ERP system integration (SAP, Oracle, etc.)

✔️ Accounting software connectivity

✔️ RESTful API framework

✔️ Real-time data synchronization

✔️ Third-party application marketplace

✔️ Custom integration support

✔️ Accounting software connectivity

✔️ RESTful API framework

✔️ Real-time data synchronization

✔️ Third-party application marketplace

✔️ Custom integration support

Complete solution designed specifically for finance and accounting professionals

Why Choose Our ARO Platform?

Our ARO platform is purpose-built for finance and accounting professionals, offering a complete end-to-end solution tailored to streamline asset retirement obligation processes. With rapid deployment through pre-configured templates, businesses can go live within weeks. Our expert support team ensures a seamless implementation backed by deep domain expertise.

✔️ Rapid Deployment: Go live in weeks, not months, with our pre-configured templates

✔️ Expert Support: Dedicated implementation team with deep ARO expertise

✔️ Scalable Architecture: Grows with your business from single sites to enterprise portfolios

✔️ ROI-Focused: Proven 30%+ cost savings through automated processes

✔️ Expert Support: Dedicated implementation team with deep ARO expertise

✔️ Scalable Architecture: Grows with your business from single sites to enterprise portfolios

✔️ ROI-Focused: Proven 30%+ cost savings through automated processes

Implementation Process

Step 1: Discovery and Assessment

involves analyzing the existing ARO portfolio, business processes, and regulatory requirements. This includes reviewing assets, auditing compliance, evaluating current workflows, conducting stakeholder interviews, assessing data quality, and identifying risks.

Step 2: Platform Configuration

focuses on customizing the ARO platform to fit specific needs and industry standards. It covers system setup, workflow design, user roles, integration planning, security settings, and compliance configuration.

Data Migration and Integration

ensures a secure and smooth transfer of ARO data into current systems. This includes data extraction, validation, system integration, testing, performance tuning, and setting up backup and recovery solutions.

Training and Go-Live

prepares users for launch through training sessions, documentation, and ongoing support. It also includes performance monitoring and resolving any issues that arise after going live.

Tailored solutions for industry specific ARO requirements

Industry Applications

Oil & Gas

Comprehensive well decommissioning, pipeline removal, and environmental restoration management.

✔️ Well plugging & abandonment

✔️ Facility decommissioning

✔️ Environmental remediation

✔️ Regulatory compliance tracking

✔️ Facility decommissioning

✔️ Environmental remediation

✔️ Regulatory compliance tracking

Mining

Mine closure planning, land reclamation, and long-term environmental monitoring obligations.

✔️ Mine closure planning

✔️ Land reclamation

✔️ Water treatment systems

✔️ Long-term monitoring

✔️ Land reclamation

✔️ Water treatment systems

✔️ Long-term monitoring

Utilities

Power plant decommissioning, transmission infrastructure removal, and nuclear facility obligations.

✔️ Plant decommissioning

✔️ Nuclear waste management

✔️ Transmission infrastructure

✔️ Site restoration

✔️ Nuclear waste management

✔️ Transmission infrastructure

✔️ Site restoration

Manufacturing

Industrial facility closure, equipment remaval, and environmental cleanup obligations.

✔️ Facility closure

✔️ Equipment disposal

✔️ Contamination cleanup

✔️ Regulatory compliance

✔️ Equipment disposal

✔️ Contamination cleanup

✔️ Regulatory compliance

Chemical

Chemical plant decommissioning, hazardous material disposal, and long-term environmental monitoring.

✔️ Plant decommissioning

✔️ Hazardous waste disposal

✔️ Soil remediation

✔️ Groundwater monitoring

✔️ Hazardous waste disposal

✔️ Soil remediation

✔️ Groundwater monitoring

Renewable Energy

Wind tarm decommissioning, solar panel recycling and site restoration obligations.

✔️ Turbine removal

✔️ Panel recycling

✔️ Foundation removal

✔️ Land restoration

✔️ Panel recycling

✔️ Foundation removal

✔️ Land restoration

Quantifiable returns from implementing our ARO management platform

Business Benefits & ROI

Cost Optimization

Reduce ARO-related costs by 25-40% through better planning, accurate cost estimation, and optimized retirement schedules.

Compliance Assurance

Achieve 99%+ regulatory compliance with automated tracking, reporting, and alerts for ASC 410 and IFRS requirements.

Compliance Assurance

Achieve 99%+ regulatory compliance with automated tracking, reporting, and alerts for ASC 410 and IFRS requirements.

ROI Calculator

How a Major Oil & Gas Company Transformed Their ARO Management

Success Story

Global Energy Corporation

a multinational oil & gas enterprise operating over 2,500+ wells and facilities across North America, faced critical challenges in managing their Asset Retirement Obligations (ARO). Relying heavily on manual processes and spreadsheets led to:

⚠️ Challenge

- Inaccurate cost estimations resulting in $50M+ in unexpected expenses

- Compliance issues with multiple regulatory authorities

- Lack of visibility into total ARO liabilities

- Inefficient resource allocation for decommissioning activities

✔️ Solution

- ✔️ Automated cost estimation using industry-specific algorithms

- ✔️ Integrated regulatory compliance tracking and reporting

- ✔️ Real-time dashboard for portfolio-wide ARO visibility

- ✔️ Predictive analytics for optimal retirement scheduling

📊 Results

$180M

Total ARO Cost Savings

Total ARO Cost Savings

35%

Reduction in ARO Costs

Reduction in ARO Costs

99.8%

Compliance Rate Achievement

Compliance Rate Achievement

18 months

ROI Payback Period

ROI Payback Period

75%

Time Savings on ARO Tasks

Time Savings on ARO Tasks

“This platform transformed how we manage our ARO obligations.

We now have complete visibility and control over our $2.8B ARO portfolio.”

Professional Accounting Tools

ARO Present Value Calculator

Accretion Schedule Generator

Personal Resources for Accountants

Popular Questions

Frequently Asked Questions

01QUESTION-01

How secure is my data with your AI solutions?

Data security is a top priority in all our AI solutions. We implement industry-standard encryption, follow strict access controls, and ensure compliance with global data protection regulations like GDPR. From initial data intake to final deployment, we follow rigorous protocols to protect your information and maintain confidentiality. Our team continuously monitors and updates security measures to stay ahead of potential threats.

02QUESTION-02

What is the typical timeline for project implementation?

Our project implementation timeline depends on the complexity and scope of each project, typically spanning 8 to 12 weeks from start to finish. Our process includes in-depth planning, agile development, rigorous testing, and iterative feedback to ensure quality outcomes. We work closely with clients throughout, ensuring.

03QUESTION-03

How secure is my data with your AI solutions?

Our AI solutions are built with security at their core. We use end-to-end encryption, strict user access controls, and adhere to data protection regulations such as GDPR and CCPA. All data is handled with the utmost confidentiality, and we regularly update our security protocols to guard against emerging threats. From development to deployment, your data stays safe with us.

04QUESTION-04

Can your solutions scale with my business growth?

Absolutely. Our solutions are designed with scalability in mind, allowing them to grow alongside your business. Whether you're expanding your user base, increasing data volume, or adding new features, our architecture supports seamless scaling without compromising performance. We leverage modular design and cloud-native infrastructure to ensure flexibility and long-term adaptability.

05QUESTION-05

What AI services does your agency offer?

Our agency provides a wide range of AI services tailored to meet diverse business needs. These include custom AI development, machine learning models, natural language processing, computer vision, and AI system integration. We also offer data strategy consulting to help you unlock the full potential of your data. Every solution is designed for scalability, performance, and real-world impact.

Cart (0 items)